FMLN, Funes and Social Movement Align to Push Progressive Tax Reform

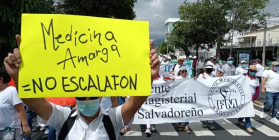

“Honest businessperson? Pay your taxes!” chanted the unionists, community organizers, family farmers, and street vendors who gathered around San Salvador´s iconic “Savior of the World” monument on December 8. The broad array of social movement organizations mobilized to pressure El Salvador's right-wing political parties to approve a new progressive income tax structure. The demonstrators also called on the economic elite to quit whining and pay their fair share of taxes. The protest was part of a series of mobilizations calling for tax reform that began earlier this year. El Salvador currently has some of the lowest tax collection in all of Latin America and over 80% of all taxes paid come from the working and middle classes. Through the many loopholes currently built into the system, conservative estimates show that El Salvador's big business evades paying more than $600 million a year in taxes. Currently, the Salvadoran government depends on large loans from multilateral financial institutions, including the World Bank and International Monetary Fund, to bankroll operational expenses. Loans also pay for the new social programs that serve historically marginalized sectors of the country, begun since the left gained the presidency for the first time in 2009. Tax reform was, in fact, one of the central campaign promises of President Funes; upon taking office he quickly began efforts to negotiate what he called a “fiscal pact” with El Salvador's economic elite. Following nearly two and a half years of fruitless negotiations, in late November the leftist Farabundo Martí Front for National Liberation party (FMLN) presented a proposal in the Legislative Assembly for a packet of tax reforms intended to create a more equitable tributary system. Apparently recognizing the futility of negotiating with big business, the Funes administration quickly presented its own tax reform proposal, very similar to that of the FMLN. Both proposals eliminate income taxes for those who earn less than $500 a month, close tax loopholes, and set modest tax increases on the country's highest-earning businesses and individuals; the administration estimates the reform will increase tax income by more than $174 million. The country's National Association of Private Business (ANEP) and Chamber of Commerce, which represent the highest grossing businesses in the country, have rejected any proposals to raise income taxes, and their allies in country's right-wing political parties have backed their position. While all parties support eliminating taxes for the lowest income brackets, a measure difficult to oppose in a pre-electoral period, the FMLN is the only party to approve raising taxes on high-income earners. However, the popularity of the proposed reforms in conjunction with social movement pressure and the upcoming elections could bring about a shift to gain the 8 votes needed in addition to the FMLN's 35 votes to pass the progressive tax reforms in the Legislative Assembly.

"I am a CISPES supporter because continuing to fight for social justice and a more people-centered country means continuing the dream and sacrifice of thousands of my fellow Salvadorans who died for that vision.” - Padre Carlos, New York City

"I am a CISPES supporter because continuing to fight for social justice and a more people-centered country means continuing the dream and sacrifice of thousands of my fellow Salvadorans who died for that vision.” - Padre Carlos, New York City